As life expectancies continue to rise globally, including here in Thailand, the prospect of living into old age brings with it a new set of considerations, particularly concerning healthcare. While most individuals focus on health insurance to cover acute illnesses and accidents, a significant gap often remains in planning for the potentially extensive and escalating costs associated with long-term care. This refers to the assistance needed when someone can no longer perform daily activities independently due to aging, chronic illness, disability, or cognitive impairment like Alzheimer’s disease. This critical need is why more individuals should consider getting long-term care insurance, a specialized form of coverage designed to protect assets and ensure access to quality care without burdening family members.

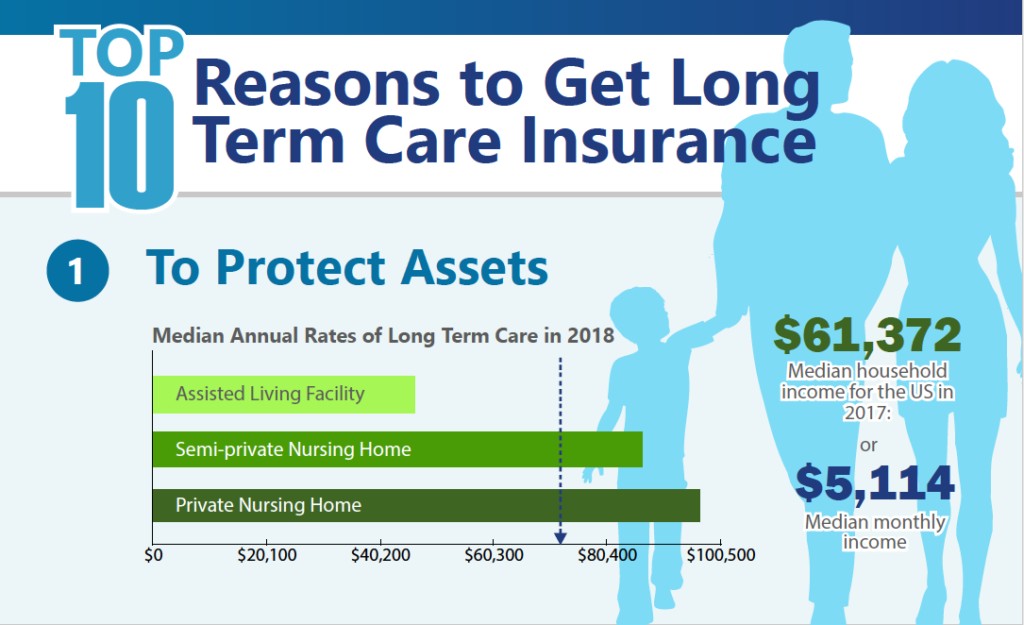

The fundamental truth about long-term care is that it is often profoundly expensive and typically not covered by standard health insurance policies, nor by government social security schemes that primarily focus on medical treatments rather than custodial care. Long-term care is not about treating a specific illness in a hospital; it’s about providing assistance with Activities of Daily Living (ADLs) such as bathing, dressing, eating, continence, toileting, and transferring (moving in and out of a bed or chair). This care can be provided in various settings: at home by professional caregivers, in assisted living facilities, or in skilled nursing homes. In Bangkok, for instance, the costs can range significantly. Assisted living facilities might cost between THB 30,000 to THB 60,000 per month, while comprehensive nursing home care, especially for those requiring round-the-clock supervision, can easily exceed THB 100,000 per month, and even up to THB 105,000 for 24-hour one-on-one care in some premium facilities. These figures quickly accumulate, potentially draining a lifetime of savings within a few short years.

Consider the financial ripple effect if long-term care becomes necessary without insurance. The burden often falls directly on the individual’s personal savings, retirement funds, or, more commonly, on their family. Adult children may find themselves in the challenging position of financially supporting a parent’s care, potentially delaying their own retirement plans, sacrificing their children’s education funds, or even having to sell family assets. Beyond the financial strain, there’s a significant emotional and physical toll on family caregivers. The demands of providing continuous care can lead to burnout, stress, and impact their own health and professional lives. Long-term care insurance mitigates this risk by providing a dedicated pool of funds to cover these services, preserving family assets and alleviating the caregiving burden on loved ones.

One of the compelling reasons to consider long-term care insurance sooner rather than later is the issue of insurability and premium costs. Like life insurance, the cost of long-term care insurance is heavily dependent on your age and health at the time of application. The younger and healthier you are when you apply, the lower your premiums will be. If you wait until you are older or have developed chronic health conditions, you may face significantly higher premiums, limited coverage options, or even be deemed uninsurable. For example, a healthy individual in their 50s will pay substantially less for a policy than someone in their 70s who has already been diagnosed with a condition like diabetes or early-stage Parkinson’s disease. The proactive step of purchasing a policy in your middle years can lock in lower rates and ensure coverage when you most likely need it.

Long-term care insurance policies are highly customizable, allowing individuals to tailor coverage to their specific needs and budget. Key features to consider include the daily benefit amount (the maximum amount the policy will pay per day for care), the benefit period (the length of time the policy will pay, e.g., 3 years, 5 years, or even a lifetime), and the elimination period (a waiting period, similar to a deductible, before benefits begin). Choosing a longer elimination period (e.g., 90 or 180 days) can lower your premiums, assuming you can cover the initial costs out-of-pocket. Some policies also offer inflation protection, which is crucial given the rising cost of healthcare; this feature increases your daily benefit over time to keep pace with future care expenses. For example, a policy might offer a THB 2,000 daily benefit with a 3% annual compound inflation rider, ensuring that a decade later, the benefit has significantly grown to match rising care costs.

While the concept of long-term care insurance is well-established in many Western countries, its prevalence in Thailand’s local market is still developing, though options from international insurers and some local providers are available. For expatriates or those planning to retire in Thailand, where the Universal Coverage Scheme is typically not accessible, private long-term care solutions become even more critical. Many individuals opt for policies from global insurers that offer coverage in Thailand, providing access to private hospitals and care facilities that meet international standards. When exploring options, it’s advisable to consult with a qualified financial advisor or an insurance broker specializing in long-term care to navigate the various policy structures and ensure the coverage aligns with your retirement plans and potential future care needs in the Thai context.

In conclusion, long-term care is a significant, often underestimated, financial risk that can erode wealth and create immense strain on families. Standard health insurance does not cover it, and the costs of assisted living or nursing home care can quickly become astronomical. By proactively considering long-term care insurance, particularly in your healthier and younger years, you can secure lower premiums, protect your hard-earned assets, and, most importantly, preserve your family’s financial stability and emotional well-being. It is an investment in dignity, autonomy, and peace of mind, ensuring that quality care is accessible should the need arise, without turning a personal health challenge into a catastrophic financial burden.