In the contemporary economic landscape, where traditional savings accounts often yield minimal returns and the cost of living steadily rises, the imperative to invest has never been more pronounced. For many, however, the world of investing appears shrouded in complexity, filled with jargon and daunting risks. Yet, understanding the foundational principles of investing is not an exclusive domain for financial magnates; it is a critical life skill for anyone seeking to build wealth, achieve financial independence, and secure their future. This guide aims to demystify the process, offering a clear, step-by-step pathway for beginners to confidently embark on their investment journey.

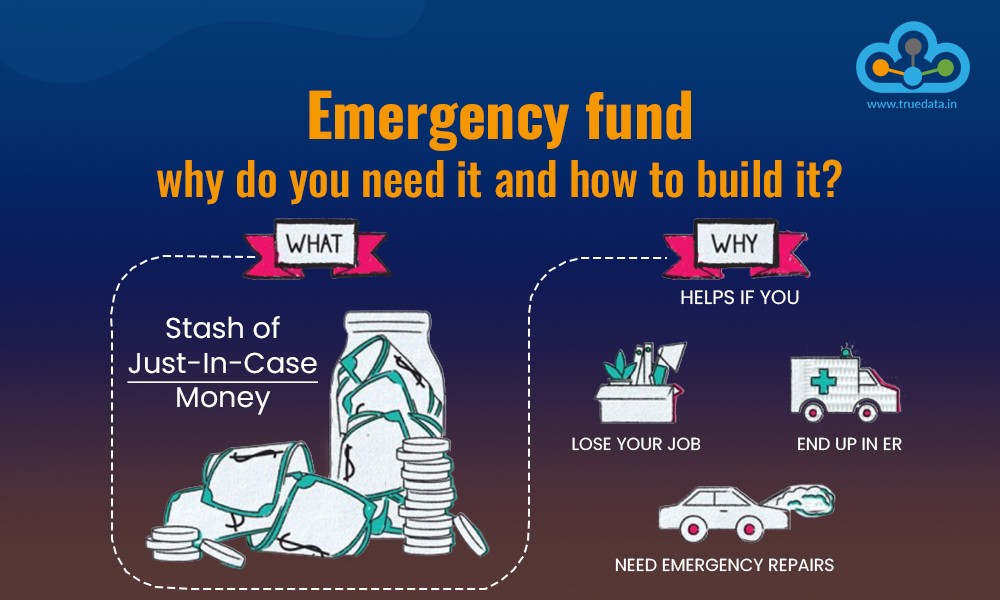

The very first step for any aspiring investor, even before considering specific assets, is to establish a robust financial foundation. This means having a clear understanding of your current financial situation, which typically involves three crucial elements. Firstly, ensure you have a fully funded emergency savings account, ideally covering three to six months of essential living expenses. This acts as a vital buffer against unexpected life events, preventing you from needing to liquidate investments at an inopportune time. Secondly, address any high-interest debt, such as credit card balances or personal loans. The interest charged on these debts often far outweighs any potential investment returns, making debt repayment a more effective immediate strategy. Finally, clarify your financial goals: Are you saving for a down payment on a home, retirement, a child’s education, or something else entirely? Defining these objectives will significantly influence your investment strategy and risk tolerance.

Once your financial foundation is solid, the next critical phase involves understanding the fundamental concept of risk and return. Every investment carries some level of risk, meaning there’s a chance you could lose money. However, generally, higher potential returns come with higher risk. As a beginner, focusing on managing risk is paramount. This often leads to a focus on diversification, which means spreading your investments across different asset classes to minimize the impact of any single investment’s poor performance. Think of it like building a sturdy table with multiple legs; if one leg wobbles, the table still stands.

For most novice investors, the ideal entry point into the market is through diversified, low-cost investment vehicles. Individual stock picking, while glamorous, is inherently risky and often yields worse returns than a diversified approach for amateur investors. Instead, consider Exchange-Traded Funds (ETFs) or Mutual Funds, particularly those that track broad market indices. An S&P 500 index fund, for example, allows you to invest in a basket of 500 of the largest U.S. companies, providing instant diversification across various industries. Similarly, global or regional index funds offer exposure to international markets. These funds are professionally managed (though often passively, for index funds) and spread your money across numerous companies, significantly reducing the risk associated with any single stock’s performance.

When choosing a platform for your investments, consider reputable brokerage firms. Many offer user-friendly interfaces, educational resources, and often allow you to start investing with relatively small amounts. Look for platforms with low or no trading fees, and transparent expense ratios for the funds you choose. These costs, though seemingly small, can eat into your returns over decades due to the power of compounding.

The next pivotal principle for beginners is the concept of dollar-cost averaging. This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. For example, committing to invest ฿5,000 every month. When the market is down, your fixed sum buys more shares; when it’s up, it buys fewer. Over time, this averages out your purchase price, reducing the risk of investing a large sum at a market peak. This disciplined approach removes emotional decision-making from investing, leveraging consistency to your advantage.

Patience and a long-term perspective are arguably the most crucial traits for successful investing, especially for beginners. The stock market is not a get-rich-quick scheme; it is a vehicle for long-term wealth accumulation. Short-term market volatility is normal and should not induce panic. Resist the urge to constantly check your portfolio or make impulsive decisions based on daily news cycles. History has shown that consistently invested money in diversified assets tends to grow significantly over decades, riding out various economic cycles. This long-term view protects you from making emotional mistakes that can erode wealth.

Finally, continuous learning is non-negotiable. The financial world is dynamic, and staying informed about basic economic principles, investment strategies, and personal finance best practices will serve you well. Read reputable financial news, listen to educational podcasts, and consider books by renowned financial experts. However, always be wary of sensationalist advice or promises of guaranteed high returns. Focus on verifiable information and established principles of sound investing.

Embarking on the investment journey can feel daunting, but by focusing on building a solid financial foundation, understanding risk and diversification, leveraging low-cost index funds, practicing dollar-cost averaging, and maintaining a long-term perspective, beginners can confidently navigate the market. Investing is not just about accumulating money; it’s about empowering your financial future, creating opportunities, and achieving the peace of mind that comes with a growing asset base. The journey of a thousand miles begins with a single, well-informed step.