In the vast and often confusing landscape of personal finance, where advice ranges from the arcane to the overly simplistic, navigating the path to financial well-being can feel daunting. While countless articles, podcasts, and online gurus offer snippets of wisdom, few resources provide the comprehensive, foundational understanding necessary for true financial mastery quite like a well-chosen book. The best personal finance books transcend fleeting trends, offering timeless principles, psychological insights, and actionable strategies that empower readers to take control of their financial destiny. For anyone serious about building wealth, managing debt, and planning for a secure future, delving into these authoritative texts is an invaluable investment of time.

One of the cornerstones of any personal finance library is **”The Total Money Makeover” by Dave Ramsey**. While his approach is often described as aggressive and highly disciplined, particularly his “debt snowball” method, Ramsey’s genius lies in his ability to motivate individuals to conquer debt with an almost evangelical zeal. He presents a clear, step-by-step plan for eliminating consumer debt, building an emergency fund, and saving for retirement and other goals. His emphasis on behavioral change and the psychological wins derived from paying off smaller debts first resonates deeply with those who feel overwhelmed by multiple obligations. For individuals in Thailand grappling with consumer debt, Ramsey’s straightforward, no-nonsense advice can provide a much-needed roadmap to financial liberation, encouraging consistent action and visible progress.

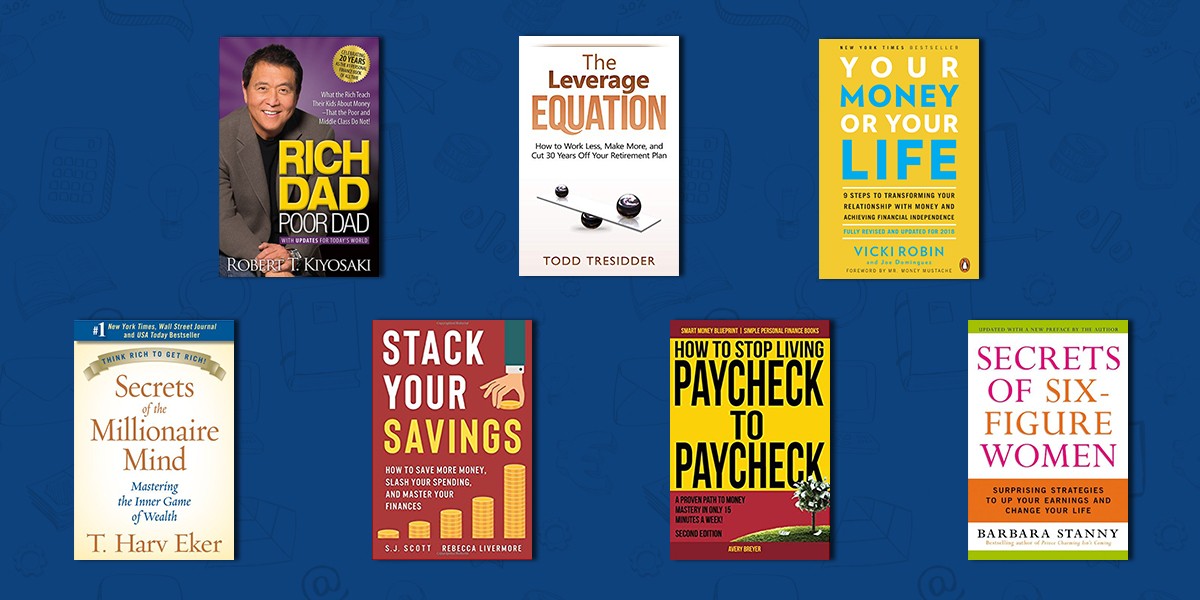

For those seeking a more expansive view of wealth building, **”Rich Dad Poor Dad” by Robert Kiyosaki** offers a paradigm-shifting perspective. This book challenges conventional wisdom about money, work, and education, advocating for financial literacy and entrepreneurship as pathways to true wealth. Kiyosaki distinguishes between “assets” (things that put money in your pocket) and “liabilities” (things that take money out), urging readers to acquire income-generating assets. While some of its specific advice may be debated, its enduring impact lies in its ability to inspire readers to think differently about money, move beyond the paycheck-to-paycheck cycle, and explore avenues for passive income and investment. It’s a powerful catalyst for shifting one’s mindset from being a consumer to being an investor and wealth creator.

For a deeply practical and universally applicable guide to managing money, **”The Psychology of Money” by Morgan Housel** is an indispensable read. Housel’s brilliant insight is that personal finance is less about mathematical formulas and more about human behavior, biases, and emotions. He illustrates how people’s unique experiences with money shape their decisions, often leading to irrational choices. The book emphasizes humility, long-term thinking, and the power of compounding, while cautioning against envy, ego, and the allure of get-rich-quick schemes. It provides a nuanced understanding of why smart people sometimes make poor financial decisions and offers profound lessons on building wealth and living a good life by understanding the emotional side of money. This book serves as an excellent complement to more prescriptive guides, offering the mental framework necessary to stick to any financial plan.

For those interested in efficient, low-cost investing, **”The Simple Path to Wealth” by J.L. Collins** is a revelation. Written as a series of letters to his daughter, Collins distills complex investment strategies into an incredibly clear and actionable philosophy: save aggressively, invest in low-cost index funds, avoid market timing, and ignore the noise. He passionately argues against expensive financial advisors and complex investment products, championing simplicity and long-term discipline. For anyone looking to understand the core principles of passive investing for retirement or achieving financial independence (like the FIRE movement), this book is an authoritative, empowering, and refreshingly straightforward guide. Its emphasis on simplicity makes sophisticated investment concepts accessible to everyone, regardless of their prior financial knowledge.

Finally, for a comprehensive overview that balances different approaches, **”Your Money or Your Life” by Vicki Robin and Joe Dominguez** remains a timeless classic. This book encourages readers to re-evaluate their relationship with money by calculating their “real hourly wage” (factoring in work-related expenses) and seeing money as “life energy.” It promotes conscious consumption, debt reduction, and a holistic approach to financial independence that aligns spending with personal values. While some of its examples might feel dated, its core philosophy of living intentionally and achieving genuine financial freedom by understanding the true cost of consumption is more relevant than ever. It pushes readers to consider not just how much they earn, but how much they truly *need* to live a fulfilling life.

In conclusion, while no single book holds all the answers, these foundational texts provide a robust education in personal finance that transcends fleeting market conditions. They equip readers with the knowledge to manage debt, save wisely, invest intelligently, and, critically, develop the psychological resilience and disciplined mindset necessary for long-term financial success. By investing time in these expert voices, individuals gain the clarity and confidence to navigate their financial journey with purpose and ultimately achieve their most ambitious monetary goals.